Headline and Core inflation came in lower than expected in both Canada last week, and also in the U.S. this week. This is a sign that inflation is cooling, or at least has peaked, and that the aggressive rate hikes made by the Bank of Canada and the Federal Reserve are indeed working, however, there is still work to do.

Central Bankers around the world indicated inflation would remain relatively elevated and a hawkish tone was prevalent in Canada, U.S. and across Europe. In their respective announcements, the BOC, the Fed, The European Central Bank and Bank of England all raised interest rates over the past week albeit, less aggressively.

The decision to reduce the pace of rate hikes is not a pivot. Core inflation in the Canada and the U.S. is more than 3 times target and Fed Chair Powell even went so far as to say “I don’t think anyone knows whether we’re going to have a recession or not, and, if we do, whether it’s going to be a deep one or not. It’s just not knowable. We will stay the course, until the job is done.”

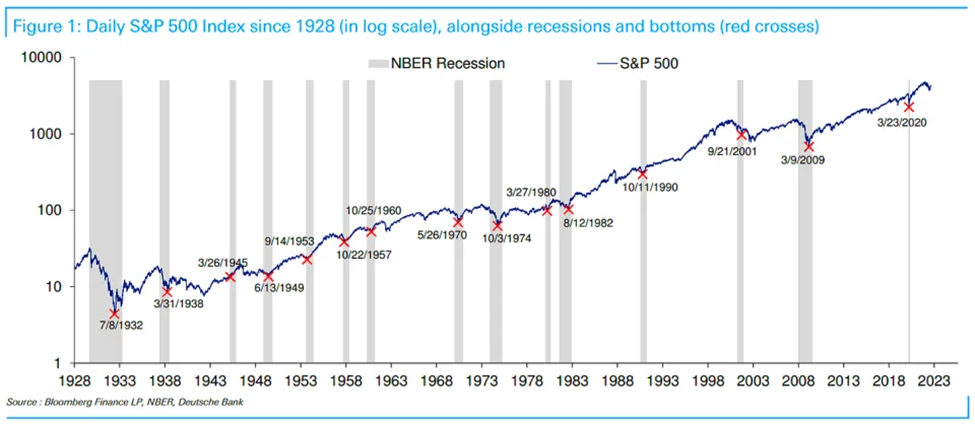

The outlook for interest rates and inflation continues to steer markets, brining fears of recession. But volatility is normal, and volatility is good. To help with this, I want to share this cart:

This shows almost 100 years of history of the S&P 500. The S&P is the go-to, de facto, index of the U.S. economy. The gray vertical bars show when past recessions happened.

From this we can see how short bear markets last and how long bull markets last. Volatility and bear markets in almost 100 years of history have been shorter lived, on average about 1 year, compared to bull markets, lasting on overage for about 9 years. Yes, there are periods of difficulty, which make the market unfriendly for investors with weak stomachs and very short time horizons. But for those with longer-term investment horizons, time in the market pays off.

Where we are right now has a lot of people worried about what will happen next and if there will be a recession. But it’s just not knowable. What is knowable is that bear markets and recessions will happen. They’re part of the economy. Just like bull markets and expansions will happen too. They are also part of the economy. But historically bear markets are short lived followed by much more significant bull markets both in duration and magnitude. In fact, investing in a down market, assuming you have the risk tolerance, can get you the amazing compound returns that come with investing in equities.

Regardless of where we are in the market cycle, it’s important to take a disciplined approach to investing and stay focused on your long-term goals. This strategy helps you keep your emotions out of investing, typically buying high and selling low like many investors do.